Wider Israel-Hamas Impacts

Oil market impact not to be underestimated: if not a shock, a sticky risk premium

Intensification of the global struggle for mastery, much hinging on US stamina

Regardless of ‘Biden vs Trump’ outcome, the rearmament theme is intact

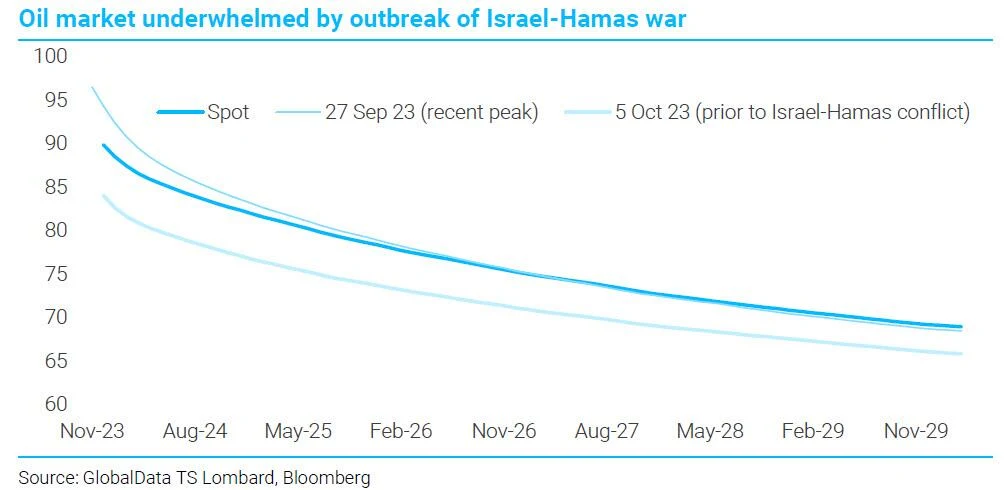

With all geopolitical flashpoints – even those that erupt into armed conflict as now in Israel and Gaza – the ‘burden of proof’ rests on the case for any ‘needle-moving’ economic and financial consequences at all. This high bar was passed last year, since the Russian invasion of Ukraine triggered an economic war (aka sanctions – on an unprecedented scale). The resulting energy price surge produced a stagflation shock. Until wars threaten physical energy supplies, the impact is limited to the fleeting sentiment channel. At the time of writing, the latest Iranian threats of “pre-emptive” new fronts being opened against Israel (“not just from Lebanese Hezbollah”) may have pushed the oil price above the $90/bbl mark; but it remains below the level that had held for a full month before the massacre in Israel carried out by Hamas on 7 October. This is shown in the chart below – along with the sticky backwardation in the oil forward curves that underlines the “fleeting” point.

However, real and sentiment-based geopolitical impacts through the oil price may be, respectively, over- and under-estimated. Although palpable while it lasted, the stagflation impulse caused by Russia sanctions evaporated after a few months as oil and gas supplies adapted to the new conditions (natural gas supply benefiting from the expansion of LNG production and trading, hence fungibility). Conversely, the Israel-Hamas war effect of increasing the risk premium in the oil price – with consequent wider economic impacts – might persist for at least as long as last year’s sanctions-related fears.

From the physical supply standpoint, there is little difference between the two cases of Israel-Hamas and Russia-Ukraine. With the brief exception of gas supplies to Europe contracting in Q3/22 as the Nord Stream pipeline route was removed, markets were responding to possible rather than actual supply shortfalls. Likewise, when it comes to the Israel-Hamas war, actual combat operations in Gaza will not prevent oil production and deliveries. The threat to physical supply necessary for a global economic and market shock depends instead, once again, on a possibility – in this case, of a wider regional conflagration. For this threat to materialize, the conflict spread would have to meet a specific condition: not ‘merely’ the opening of other Israeli fronts from the Lebanese border zone to the Golan Heights or the Red Sea, but instead to Iran and its Gulf neighborhood where material volumes of oil are produced and shipped to the world market through the Hormuz strait chokepoint.

Here then is the known unknown – of war directly involving Iran – on which an avalanche of commentary is now pouring out. However high or low this risk, it will persist as long as the fighting in Gaza continues. Israel likens Hamas to ISIS – in the sense that both are murderous fanatics who cannot be negotiated with, only destroyed for the sake of self-preservation. The best indicator of conflict duration may therefore be the experience of battles against ISIS in 2016-17. The battle for Mosul (northern Iraq) lasted ten months, while it took a US expeditionary force five months to conquer Raqqa, the capital of the ISIS ‘caliphate’ in Eastern Syria. Based on this record, the battle for Gaza will last for months rather than weeks, let alone the ten days or so that has been the average duration of the string of previous Israel-Hamas conflicts since 2006.

For as long as the fighting in Gaza lasts, Iran will continue to issue loud threats: and regardless of whether anything ever comes of such threats, this will be enough to preserve a ‘Israel-Hamas’ increment in the oil price risk premium. Speculation about Iranian proxies attacking Israel at one or more points in an 'arena' spanning Lebanon (Hezbollah), Syria (Shia militants, perhaps reinforced from Iraq) and the Red Sea (Yemeni Houthis) may overestimate Iran’s ability to control such proxies, let alone supply them with materiel while creating functional logistics for the purpose in new combat theatres. The certainty in any case is that Iran will maintain active efforts to exploit the Israel-Hamas conflict in its own strategic interests. The blend of ideology and pragmatism in this strategy is harnessed to the paramount interest of regime preservation. The Islamic Republic’s foundational slogans of “Death to America” – and “to Israel”, seen as an American “colonization” of the Muslim world – give Iran’s exploitation of the Israel-Gaza war its distinctively aggressive edge, to the point of celebrating the bloody deeds of Hamas fighters.

Comparing the Iranian stance with that of the other external powers opposing the US, they differ more in degree (or tone) than in kind (substance). In their public statements and positions, China and Russia are more measured and less interventionist than Iran in diplomatic, let alone military, terms. For example, they do not support the savagery of 7 October, but instead pass over it in silence (as in this week’s Russia-sponsored, China-supported UN Security Council resolution calling for a ceasefire in Gaza that was vetoed by the US, UK and France). Israel’s problem is seen as America’s problem – hence an opportunity to extract advantage. In the contest for ‘hearts and minds’ in the ‘Global South’, the Palestinian predicament supports the case that the “rules-based order” trumpeted by the US is a sham.

This anti-American animus underpinning global fragmentation raises the decisive question of the US response – a long-term geopolitical theme with a bearing on the ‘live’ investment theme of rearmament. The alternatives here, respectively fronted by Joe Biden and Donald Trump, are maintaining US global power projection and isolationism.

The outcome ultimately depends on US society and the resulting political effects. Asked by a TV interviewer on 16 October about America’s will and ability to supply multiple battlefronts (Gaza now added to Ukraine, with the Taiwan war threat always lurking in the background), Biden replied: “We can take care of both of these and still maintain our overall defence [since] the USA is the most powerful nation [not only] in the world but in the history of the world.” But US public opinion is tiring of support for Ukraine (shown by the poll findings summarized in the table above underlining the partisan polarization here) – a view both fomented and exploited by Trump and his allies on Capitol Hill. The version of isolationism on offer from Trump and his ‘America First’ camp incorporates, however, bombastic assertion of the country’s status that translates notably into a China view that is no less, if not more, hawkish than that of their liberal internationalist opponents. Whichever way the US domestic political struggle tilts, fiscal muscle will be applied to rearmament (and the associated non-outsourceable industrial employment) on the full spectrum from upgrading the nuclear ‘triad’ to mass production of drones and more traditional munitions.

By Christopher Granville of TS Lombard